Thoughts for General Insurance Actuaries

As alert levels for Covid-19 heighten and risk management strategies are put in place, there is an uneasy level of uncertainty actuaries and businesses are facing. Estelle Pearson, Principal at Finity Consulting, writes about what this pandemic situation means for General Insurance actuaries.

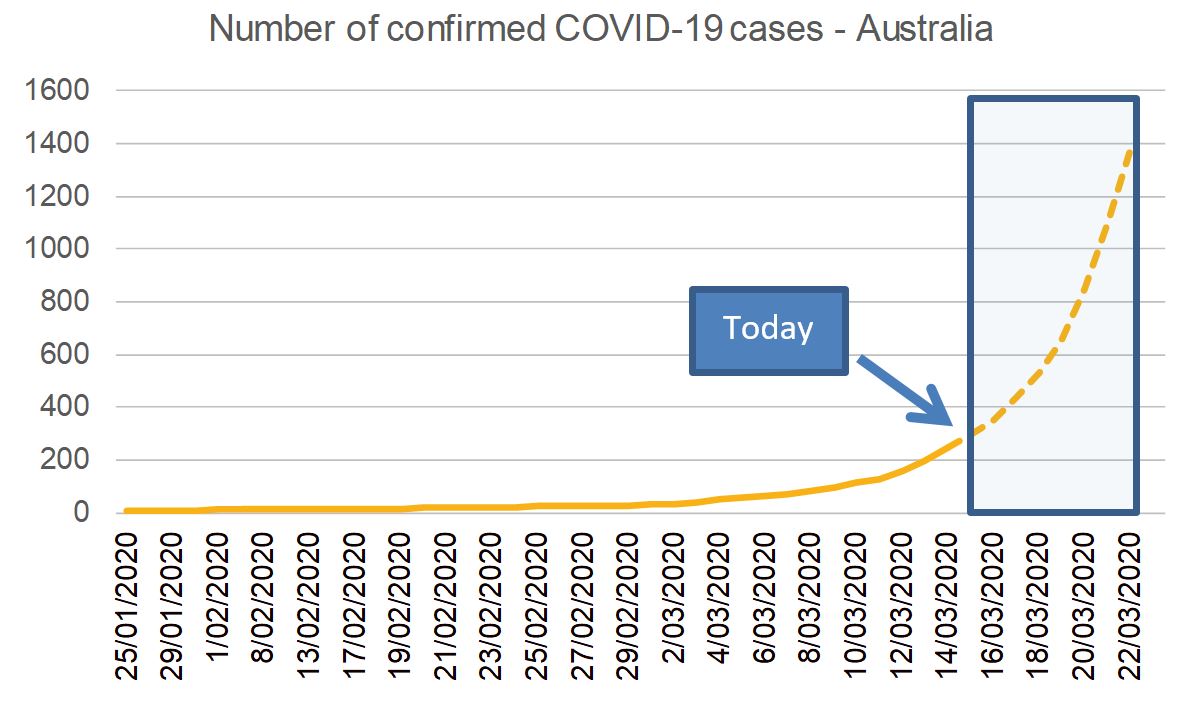

On 11 March 2020, the World Health Organization (WHO) labelled COVID-19 a pandemic due to “the alarming level of spread and severity and (by) the alarming levels of inaction”. As of 15 March the number of confirmed COVID-19 cases in Australia had reached almost 300, the Federal Government had recommended cancelling gatherings of over 500 people and – following earlier travel bans on Italy, South Korea, Iran and China – the Prime Minister announced a 14 day self-isolation period for all people entering Australia and a ban on cruise ships from international ports.

Many other countries have imposed more stringent ‘social-distancing’ measures including banning all gatherings, closing schools and universities and all non-essential businesses and restricting travel to allowable purposes.

Based on very simple extrapolation and assuming a one week delay between infections and case confirmation, we can easily expect the number of confirmed Australian COVID-19 cases to surpass 1,000 within a week and to continue to grow.

The main focus at the moment is quite rightly on the public health issues of COVID-19. However, the insurance regulator already asked insurers back in February about their pandemic business continuity plan and has more recently requested an update as well as details on the potential financial impacts on both the insurance book and investment book. Under the Actuarial Advice Framework, it is to be expected that insurers will ask their Appointed Actuary for input in responding to these requests.

The purpose of this note is to provide actuaries working in general insurance with some initial thoughts around how to assist their clients and employers in thinking about the insurance book impacts of COVID-19. It is not intended to be exhaustive and nor could it be in these unprecedented times and as the response to COVID-19 continues to evolve both in Australia and globally.

Insurance Book Impacts

The insurance book impacts can be thought of as direct, indirect and economically-driven.

Direct impacts relate to claims arising directly from COVID-19. Classes of business likely to be impacted are travel insurance, personal accident, business interruption, event cancellation and workers compensation. Policy wording and exclusions will be important in terms of whether and how policies respond; many insurance contracts have pandemic exclusions for example. The date of policy issue will also be important for Travel Insurance given the escalating level of travel warnings since 20 January 2020. Consideration may also need to be given to whether exclusions meet “community standards” if they will result in large numbers of declined claims, especially if the wording is at all vague.

An insurer’s customer profile will also impact, for example there would be expected to be larger business interruption/cancellation impacts on the tourism, entertainment, education and child care sectors. From a workers compensation perspective the health care and other frontline sectors are likely to be more exposed to employment-related COVID-19 infections leading to time off work, however other high people contact sectors like retail and cafes/restaurants might also be expected to have higher than average exposure .

Another direct impact may be liability claims arising from a perceived breach of duty of care in relation to visitors, contractors or those under care, especially in the health care, aged care and disability sectors.

Indirect impacts relate to changes in claims costs arising from changed business conditions because of COVID-19. For example, disruptions in supply chains may lead to both delays and inflation in claims costs. China is a major manufacturer of building supplies and we might expect to see inflation in these costs with a flow on impact to home and commercial property claims costs. This might also extend to the cost of motor vehicle parts and repairs, impacting motor insurance.

Other indirect impacts may include –

- Increased level of stress related workers compensation claims

- Decrease in RTW in workers compensation and CTP claims due to lack of available alternate work duties

- Increased E&O claims where a key team member is unable to perform their role

- Increased D&O claims where a firm fails to have adequate contingency plans in place

- Increased errors in hospitals due to the general pressure on the healthcare system

Finally we might expect that the very necessary restrictions on travel and commerce being put in place to contain COVID-19 will impact economic growth globally and lead to significant financial strain on a large number of businesses; in Australia this comes on top of a prolonged drought and a catastrophic bushfire season that have already led to financial vulnerability in a number of regions and sectors.

The classes of business where claims costs are likely to be affected by economic impacts are –

- D&O and professional indemnity with increased claims arising from business and investment scheme failures; some sectors (e.g. travel, education, retail) will be more vulnerable

- Mortgage insurance, due to increased unemployment and depressed economic conditions leading to higher default rates and house price decreases

- Consumer credit, through higher unemployment and sickness benefits

- Trade credit, surety and guarantees

Of course, there are aspects of the restrictions that we are seeing that will reduce claims costs while they are in place. There are likely to be fewer journeys leading to lower motor vehicle accidents and a reduction in claim frequency for motor insurance and CTP. With more people working from home or staying at home, there will be fewer home property damage and theft claims. Generally, restrictions and less economic activity may lead to fewer claims across a number of classes

It is impossible to estimate the impact of COVID-19 on insurance claims costs with any level of certainty. The response to COVID-19 in Australia and globally continues to evolve. Overall, the general insurance industry will not be one of the most heavily impacted sectors. However the impacts are not necessarily immaterial and careful thought is required to enable insurers to get a handle on the potential implications. It is a classic “how to measure anything” problem, and actuaries can help establish some boundaries around this measurement by building ‘models’ based on exposure and impact-scenarios.

We can use some of the data now being published on COVID-19 to look at infection rates, morbidity and fatality rates by age-group. We can understand our exposure by industry and go back to losses arising from the GFC to develop some “what-if” scenarios for losses arising from increased insolvencies. We can understand the components of claims costs relating to building materials and look at the demand-inflation impact of past catastrophes.

This note has focused on the potential impact of COVID-19 on general insurance claim costs. Other considerations for actuaries include –

- The details of reinsurance cover, where an insurer is expecting an increased volume of claims to understand how reinsurance will respond to this event and whether any sub-limits apply. Monitoring any rating agency commentary on individual reinsurers who may have life and health as well as GI exposures.

- The impact on business plans and premium projections from both a temporary and possibly longer term slowdown in the economy. There will be a significant impact in the immediate future on premium volumes for Travel, for example.

- The impact on claim reporting patterns of a potential slowdown in claim lodgments as well as any processing and fulfilment delays as business continuity plans are tested in unprecedented circumstances; especially as there may also be reliance on third party suppliers and partners.

- Any contagion risk relating to other businesses operated in Australia and overseas with greater vulnerability to COVID-19 impacts.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.