Innovations in Reserving Processes: Case Studies

In the latest article in the General Insurance Practice Committee (GIPC)’s GI Reserving Working Group series, we explore ways that actuaries can drive improvement.

We summarise recent work across five, mostly large insurers, where teams have updated or overhauled legacy spreadsheet processes to tackle various challenges, such as the complexities of a changing portfolio, tight timelines for turning around results or high operational risk.

Approaches vary – whether it’s the integration of machine learning algorithms to detect and model changes in the portfolio, end-to-end automation to accelerate workflows, or the adoption of rigorous governance frameworks to ensure accuracy and compliance.

The tools used also vary, including open-source software (R) and vendor software (Dataiku, Psicle, Snowflake) alongside some targeted use of spreadsheets – suggesting that teams do have a range of viable options to consider.

The examples illustrate that both incremental and transformative change are achievable, highlighting realised benefits as well as some of the challenges and drawbacks.

We hope that actuaries can find relatable elements within – and perhaps a bit of inspiration to look at ways of improving the speed, governance and rigour of their own process.

Case study 1: Specialty insurer

A new reserving process built across a combination of generic data, ML vendor platforms and Excel, as part of an in-housing project.

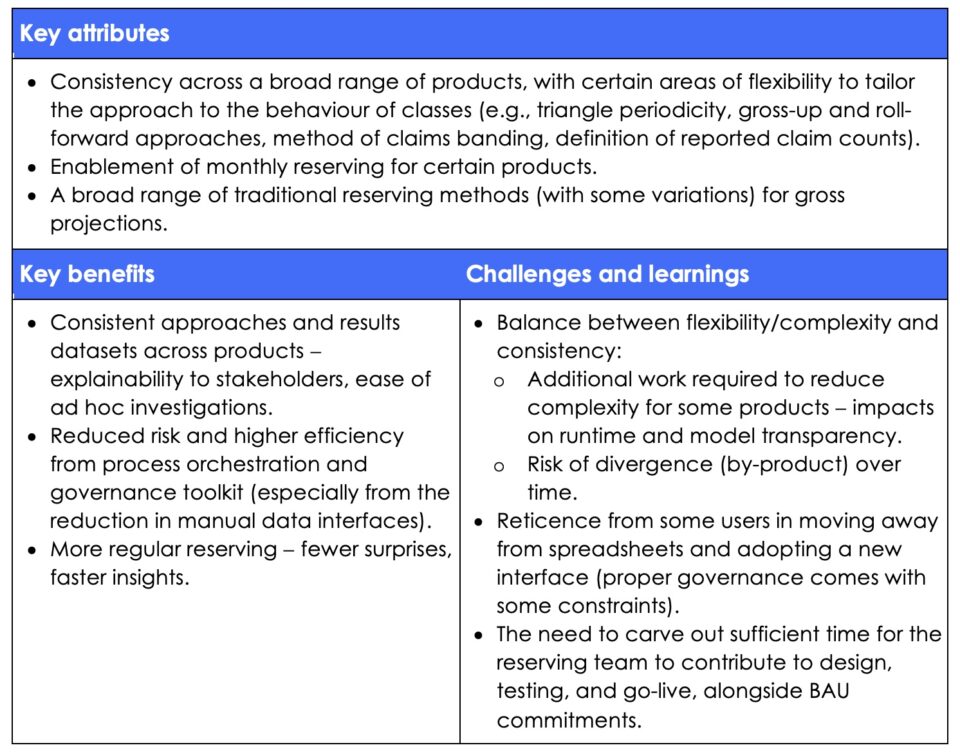

Case study 2: Large commercial and personal lines insurer

A new reserving process was built into vendor software as part of a multi-year reserving transformation project.

Case study 3: Large health insurer

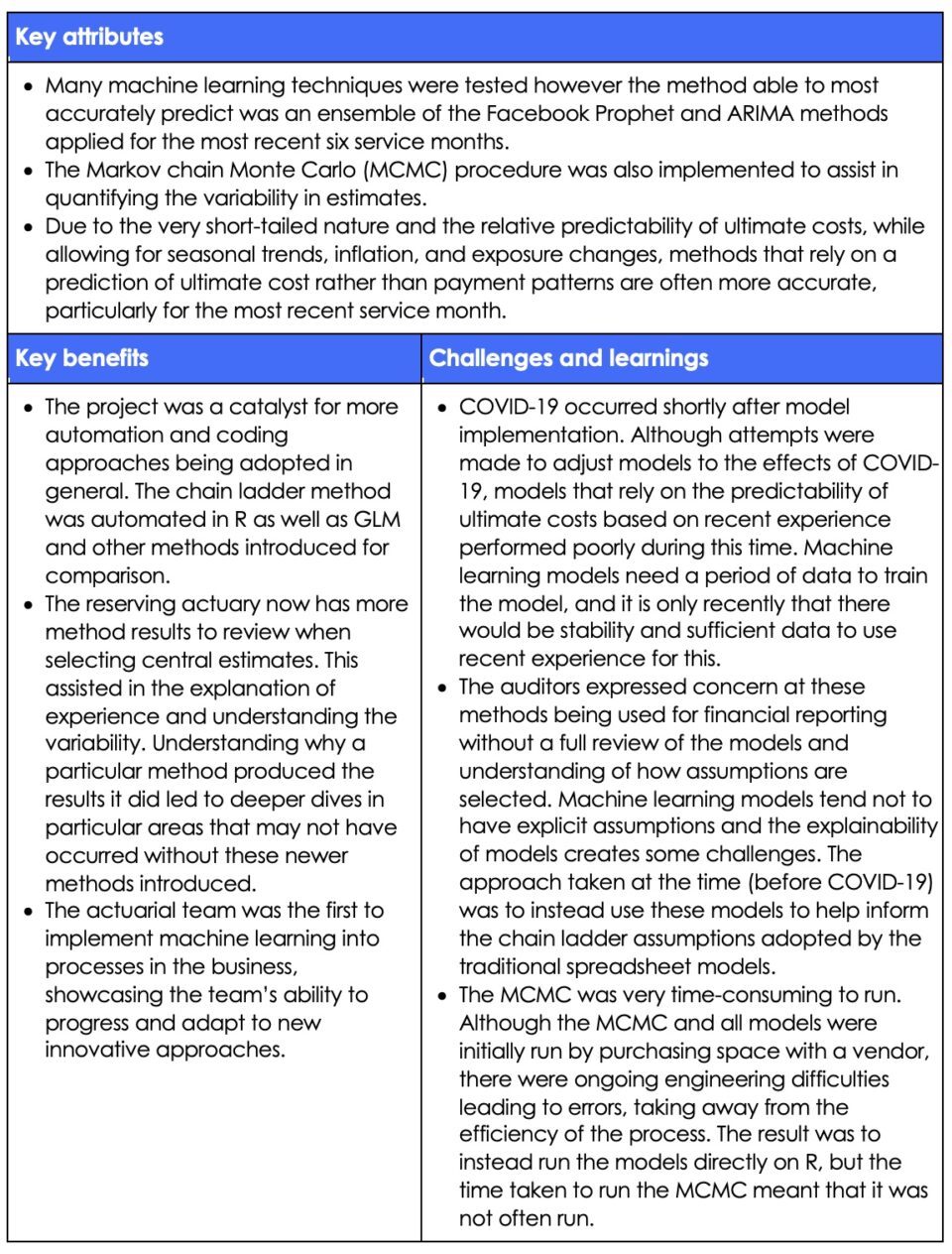

Development of a machine learning process using R to run alongside the traditional actuarial reserving approaches to test whether it could provide better predictions during a time in the data history of changing hospital payment delays from both providers and internally.

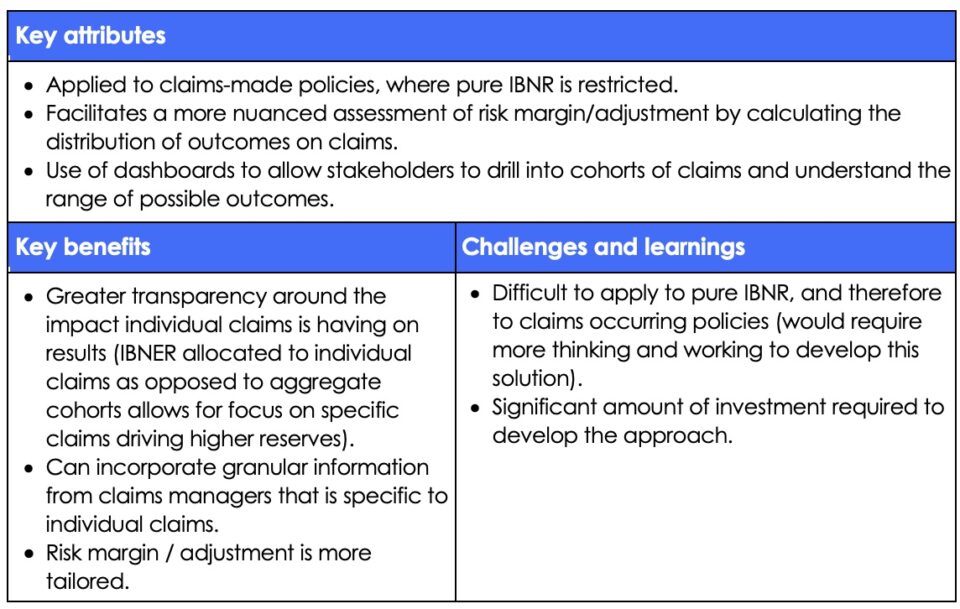

Case study 4: Large insurer writing claims-made policies

An alternative approach to traditional aggregate reserving which involves assessing IBNER on a claim-by-claim basis.

The process involves creating a transition matrix that considers the probability of a claim landing in a range of size brackets (nil, small, medium, or large) based on its characteristics.

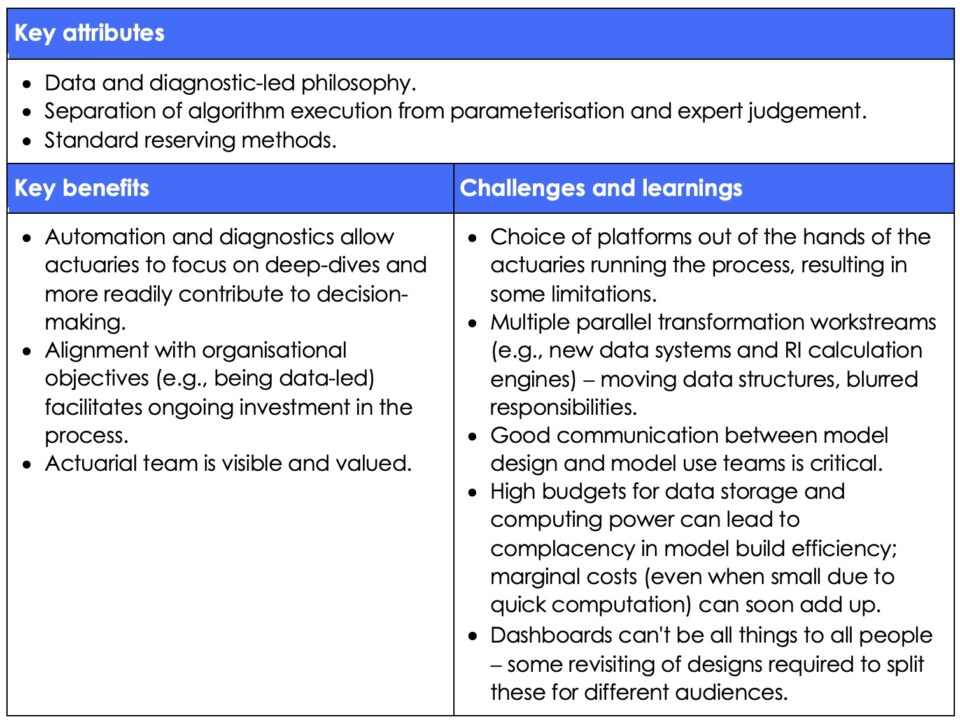

Case study 5: Large commercial and personal lines insurer

An in-house and open-source reserving process rolled out as part of a multi-year reserving transformation project.

Opportunities for industry-wide progress

While a recent survey indicated that most GI actuaries are satisfied with current practice, these case studies show that reserving processes are nevertheless evolving. Whether by end-to-end transformation in vendor platforms, migration to open-source tools or modest adjustments to algorithms, this is occurring in different ways – adapted to the needs, skills and resources of teams and organisations. Challenges remain, but the realised benefits are compelling.

So, how can actuaries get started with making change? There is no single approach, but you’ll probably need to sketch out a business case and an achievable roadmap. And get your team involved – it’s a great opportunity to learn new skills and challenge the status quo.

Check out other articles in this series here.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.