Pollard’s Political Persuasion

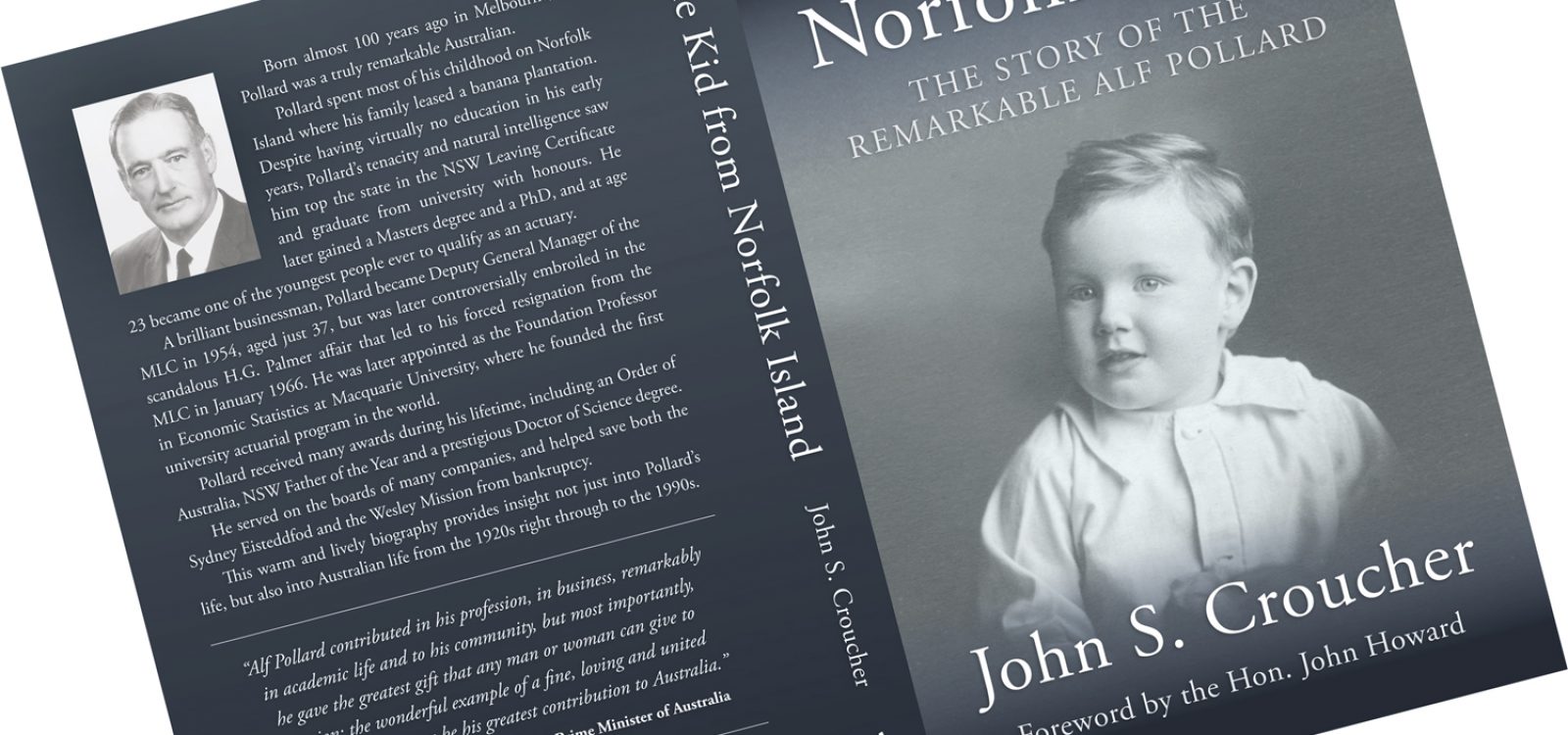

As is clear from his biography, The Kid from Norfolk Island, Alf Pollard was not shy in coming forward with his views on public policy. Not only one of Australia’s most outstanding actuaries.

Alf was a member of the Liberal party, and regularly advised the former Prime Minister John Howard on a wide range of matters – even when his counsel wasn’t sought.

Arguably there have been other actuaries who have made an outstanding contribution to the profession, but very few have had anything resembling the political influence of Professor Pollard. I think our collective failure to continue this legacy is neither in the interest of the profession, nor in the interest of Australia.

Given that Professor Pollard’s height of influence was in the previous century, it seems strange to me that members of the Institute are questioning whether or not the profession should actively seek to contribute to public policy. It’s nothing new. Pollard was doing it successfully for a long time.

Further, some members also believe that whilst we might contribute to public policy, we should not enter into political debate. I think that is a terribly naïve view. Just last week our CEO and our president were commenting in public on the current government’s freezing of the super guarantee. By laying out the facts on longevity, and challenging the political spin of the politicians, the Institute made a valuable contribution to the political debate, which was in the interests of all Australians.

As I have frequently argued in my editorials, we as actuaries have much to contribute in many areas. Fundamentally our training is about making rational commercial decisions based on evaluating scientific and quantitative evidence. In a world where decisions are driven more by celebrity endorsement than by evidence, this is vital work.

Some members also believe that we should not contribute in areas where we have no expertise. It’s hard to argue against that, but our ‘expertise’ is wider than some might think. For example, it seems to me that any life pricing actuary today would need to understand the potential impact of diabetes on morbidity and mortality in order to provide reliable estimates of risk premiums. I’d even argue that it would be tantamount to professional incompetence if they didn’t. However, that is very different from insisting that life actuaries must be expert endocrinologists. It is therefore entirely appropriate that the Institute has a policy on trends in longevity and its implications for our finances.

As actuaries, our training is about making rational commercial decisions based on evaluating scientific and quantitative evidence. In a world where decisions are driven more by celebrity endorsement than by evidence, this is vital work.

Similarly, any actuary pricing home insurance or property reinsurance today needs to have a good understanding of the potential impact of climate change on natural perils and hence premium rates, even if it is to simply conclude that no adjustment is required in the short term. When the CSIRO – a bastion of scientific and quantitative research – is providing strong evidence that climate change is 99.999% due to man, it would be sorely remiss of actuaries to fail to consider future trends in man-made emissions and natural perils when estimating premium rates. Again, we don’t have to be expert climatologists or civil engineers, but we do have to be experts in pricing insurance. The Institute needs to have a policy on trends in climate change and its implications for our finances. Without it, we are simply failing to do our job.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.